We finance general purpose equipment such as packing machines and office equipment heavy industrial equipment such as manufacturing lines printing presses and stationary machinery construction equipment and commercial vehicles typically greater than 2 5 tons such as heavy trucks and trailers.

Used farm equipment financing rates.

But in reality anyone can offer low rate financing.

As specialists in farm financing we have the understanding necessary to provide you with the tailored products and services you need to be productive.

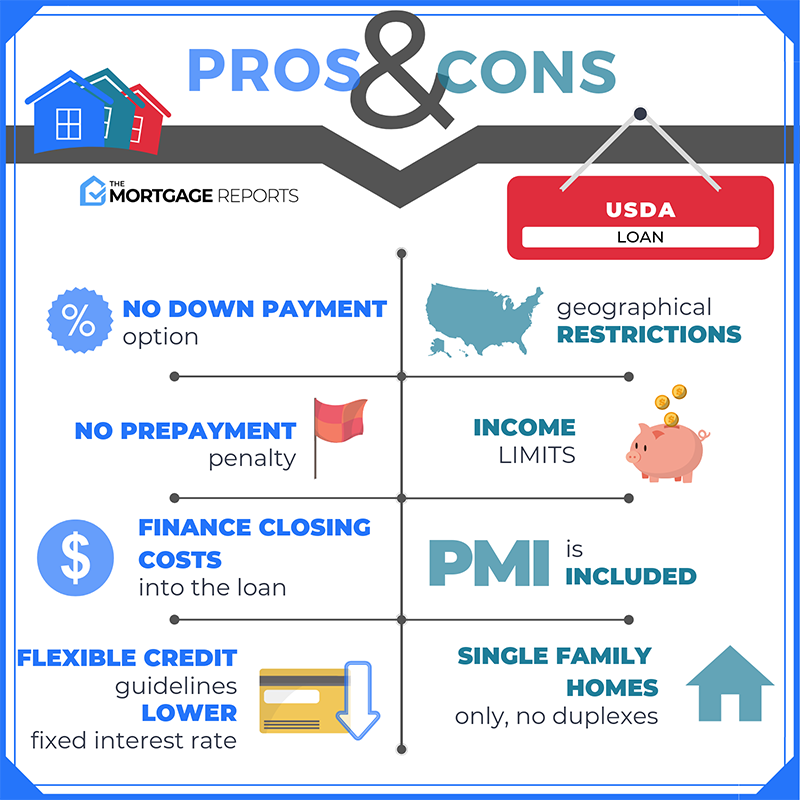

Up to 90 financing for new equipment and 85 for used.

You can sometimes get really good interest rates 5 per year or less apr if you are buying directly from a dealer such as from a john deere dealer for example with.

It s easy to understand why agdirect is among the fastest growing farm equipment financing brands in the nation.

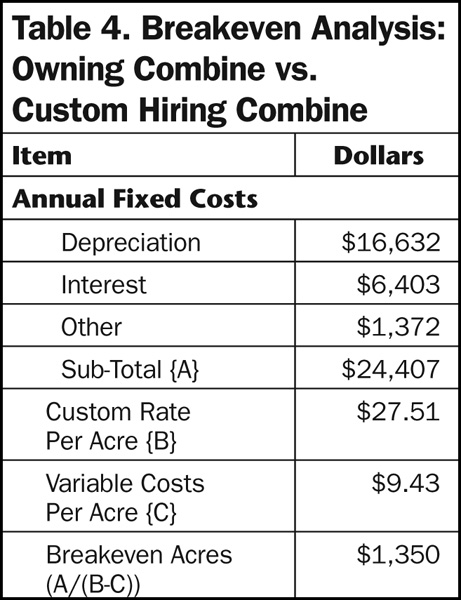

Business loans financing farm related services such as custom application.

Get lease and loan options for all the equipment you need to keep your farm running acreage maintained and animals comfortable.

Other equipment may apply.

Financing for large and compact tractors sprayers combines tillage equipment utility vehicles and more.

Semi trucks septic trucks dump trucks and trucks 19 500 lbs equipment.

Special pro put and fpo residuals on new and used grain carts dump carts forage wagons dump wagons tillage equipment and heads cornheads drapers platforms.

Special pro and put residuals on new and late model used 2015 or newer combines for a limited time only.

Lock in a low lease payment with agdirect s special lease residuals.

Farm tractors bulldozers forklifts plows skid steers livestock trailers and lawn equipment.

Whether you buy equipment from a dealer at an auction or a private party choose agdirect to finance it.

Leasing acquire flexibility and potential tax benefits.

Short term loans modernize with affordable convenient financing.

Farm credit services of america offers agdirect equipment financing available at your equipment dealer at auctions traditional or online and for private party ag equipment purchases.

Serving michigan and northeast wisconsin greenstone provides loans for equipment livestock and facilities have terms up to seven years with customizable repayment options and interest rates.

No matter what state your operation is in john deere financial can provide customized solutions from a variety of farm equipment financing options that better match your cash flow to flexible and innovative input financing.

Competitive rates on long term fixed rate financing options.

Along with options to buy lease or refinance you ll find attractive rates and the most ag friendly terms in the business.

Terms up to 7 years for new and used equipment.

More than offering attractive rates we offer ag friendly financing options experience knowledge and service.